Bank branch client-manager interaction

In this Blog:

- What is Appointment Scheduling Software and how does it work?

- Why is it necessary to deploy in bank branches?

- What are the expected benefits for consumers, staff, managers and the business and industry at large?

The pandemic, question and detest it while we may, has been instrumental in catalyzing the need for improved and streamlined processes and policies in financial institutions, like banks and credit unions. This includes the reassessment of the purpose and evolution of the retail banking branch network.

Amongst these changes were those that brought digital channels into the forefront of customer service. Especially the need for bank branch appointment scheduling software – the need to anticipate branch walk-in traffic in order to manage more optimally. The industry is primed and ready for a change that will increase branch based interactions via digital and mobile channels, and appointment scheduling is the answer.

Why Do We Need Online Appointment Scheduling Solutions?

Financial institutions, more so than the rest of the retail industry, have intimate personal relationships with customers. This is because money is important to us, and to trust it with an establishment requires human connection. And also due to the personal associations formed when these institutions help us achieve major financial milestones like buying a house or retiring.

These bodies help us manage the fruit of our hard-earned monetary gains, and we trust them to have our best financial interests at heart.

People still prefer to visit bank branches for face-to-face interactions with those handling their finances – be it for acquiring loans, account opening, wealth management, pension or insurance enquiries, mortgage or account issues, etc.

To make this process safe, socially distanced and efficient for both the visitor and those serving them, digital appointment scheduling software is necessary.

The following are some of the reasons why your bank needs to make the switch to Wavetec’s Appointment scheduling solution, and fast!

Advantages for the Customer

Surety and Safety

Appointment scheduling software ensures that customer service standards are maintained, as are social distancing guidelines and occupancy limits. Consumers can schedule an appointment according to their availability, thereby planning their own day, week or month better around their banking needs.

They will also receive the benefit of being matched up with a service provider whose skills are best suited to service them and their unique needs. This will make their appointment scheduling worthwhile.

Convenience

Branch appointments can be scheduled round the clock, from digital channels like web or mobile, from the security of one’s own home and on one’s own time! With multilingual language capabilities, this is a sure way to increase customer satisfaction and ensure continued trust in your retail branches’ digital services and solutions.

Advantages for the Business

Managed Productivity

By being aware of the volumes of consumers expected at each operational hour, banks and credit unions are able to plan resource distribution and business operations better. They can maintain branch occupancy limits ensuring staff safety, increase agent sales output, convert more web and mobile searches to scheduled appointments and reduce operational costs while increasing revenue and profits.

Their digital channels and their operation would also be bolstered. As would client onboarding to these channels – regardless of demographics. Branch resources will be utilized more optimally, ensuring industry leading standards of customer care.

With scheduled appointments, managers can delegate work to staff more optimally, allowing them and the business to plan ahead – like deciding what alternative services to introduce the client to when they arrive for their appointment.

User-friendly and Data-driven solutions

Ours is a user friendly, unified online appointment scheduling system designed and customizable for all customer experience channels (especially self service) that can be integrated with customer queue management and digital signage solutions. This allows for predictive analysis and the further personalization of your in-branch customer journey.

The omnichannel customer experience is optimized and client relationship-centered banking is now centrally controllable. Your branch service standards will remain consistent, your walk-away rates will be reduced and your Net Promoter Scores will soar!

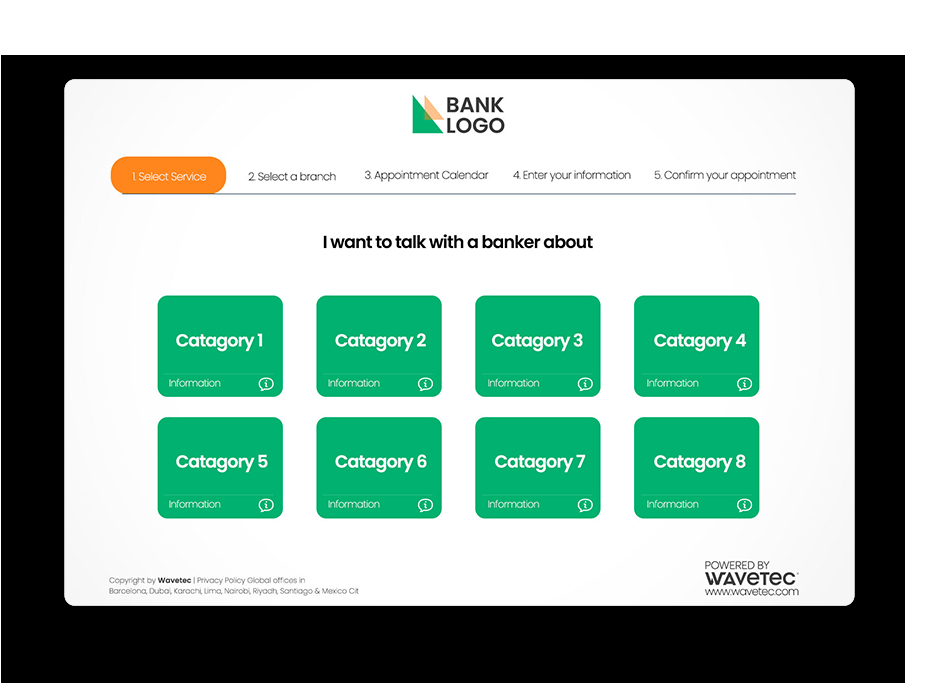

How to Effectively Schedule an Online Appointment

Whether your scheduling system is mobile app based or via your existent website, the workings are hassle-free for all kinds of clients, with a variety of needs. From the comfort of their home, the customer will begin booking the appointment by following the free appointment scheduling link. They will select the service they will be visiting to avail of.

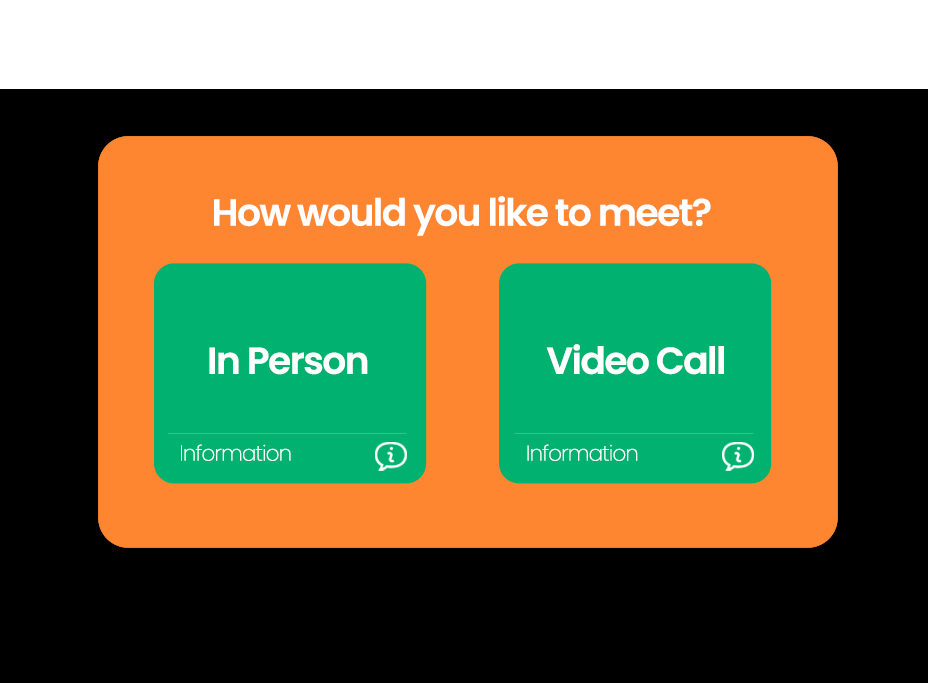

They will then choose how they prefer to meet, whether in person or via video call.

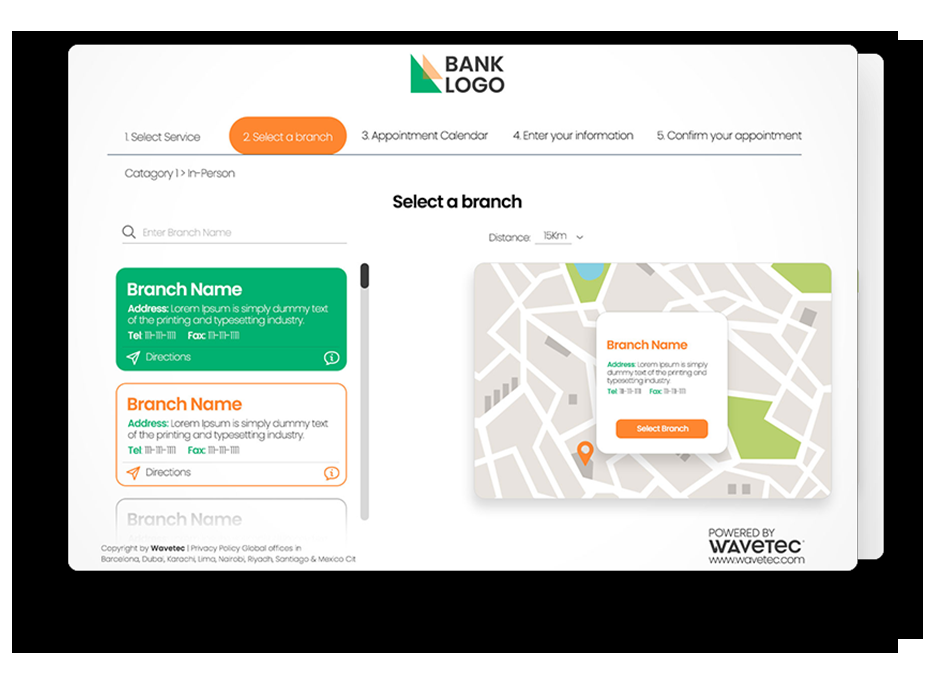

If they select in person meetings, they will be directed to choose the branch closest to them by typing it out, picking an option or letting their location services handle it for them. And for those selecting the video-calling option, they will be set a link to follow.

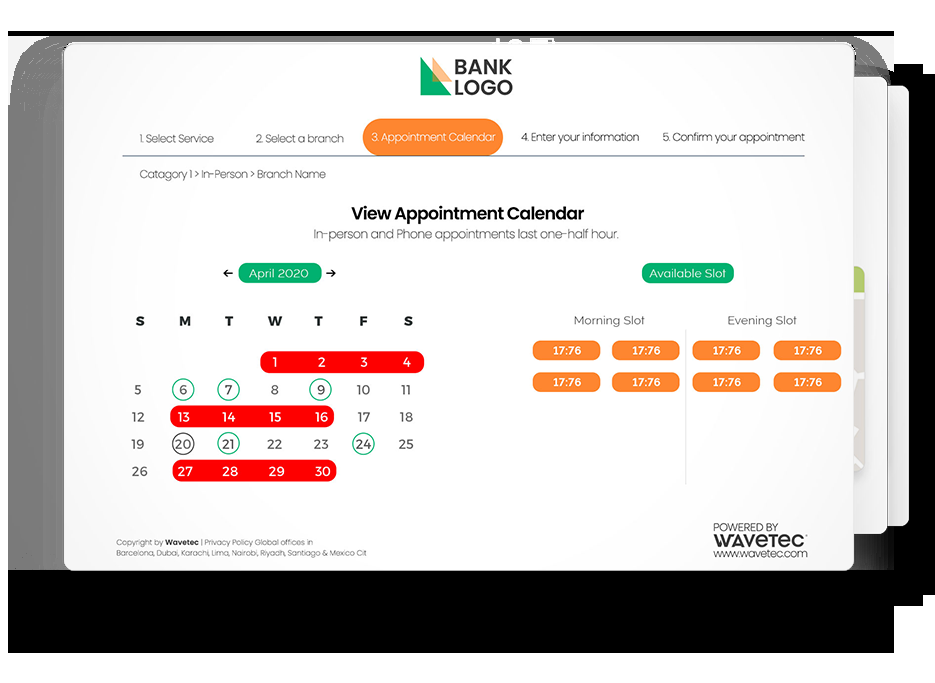

Once the most convenient branch has been picked, they consult their diaries and select the most appropriate time slot.

Next, they will be asked to enter personal details, such as name, email address, etc. (all data collection from consumers is secure) and confirm the booking. Their appointment has been booked using a seamless scheduling software.

Once booked, they can manage and monitor appointments, scheduling, rescheduling and cancelling at will, via phone

Book your free demo today to see what all the hype is about.

{{cta(‘8b26a45d-b6e1-4b6e-8cd6-cb1f15ca411a’,’justifycenter’)}}

BOOK A FREE DEMO